Bluwhale Node

Purchase AGREEMENT

GENERAL NOTICE

THE NODES ARE NOT BEING OFFERED OR DISTRIBUTED TO ANY RESIDENT OF OR ANY PERSON LOCATED OR DOMICILED WHERE SUCH OFFERING IS PROHIBITED, RESTRICTED OR UNAUTHORISED IN ANY FORM OR MANNER WHETHER IN FULL OR IN PART UNDER THE LAWS, REGULATORY REQUIREMENTS OR RULES IN SUCH JURISDICTIONS. THE OFFER AND SALE OF THE NODES DESCRIBED HEREUNDER HAS NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (“SECURITIES ACT”) OR UNDER THE SECURITIES LAWS OF ANY STATE OR FOREIGN JURISDICTION. THIS OFFERING IS BEING MADE OUTSIDE THE UNITED STATES TO NON-U.S. PERSONS (AS DEFINED IN SECTION 902 OF REGULATION S UNDER THE SECURITIES ACT) (AND ONLY IN JURISDICTIONS WHERE SUCH OFFER AND SALE IS PERMITTED UNDER APPLICABLE LAW) IN RELIANCE ON REGULATION S UNDER THE SECURITIES ACT. THE NODES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE SECURITIES ACT AND APPLICABLE STATE AND FOREIGN SECURITIES LAWS PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR AN EXEMPTION THEREFROM.

NOTICE TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA (“EEA”)

IN RELATION TO EACH MEMBER STATE OF THE EEA, NO OFFER OF SECURITIES MAY BE MADE TO THE PUBLIC IN THAT MEMBER STATE EXCEPT: (A) TO ANY LEGAL ENTITY WHICH IS A QUALIFIED INVESTOR AS DEFINED IN THE PROSPECTUS REGULATION; (B) TO FEWER THAN 150 NATURAL OR LEGAL PERSONS (OTHER THAN QUALIFIED INVESTORS AS DEFINED IN THE PROSPECTUS REGULATION) AS PERMITTED UNDER THE PROSPECTUS REGULATION; OR (C) UNDER ANY OTHER CIRCUMSTANCES FALLING WITHIN ARTICLE 3(2) OF THE PROSPECTUS REGULATION, PROVIDED THAT NO SUCH OFFER OF SECURITIES WILL REQUIRE THE ISSUER TO PUBLISH A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS REGULATION, OR SUPPLEMENT A PROSPECTUS PURSUANT TO ARTICLE 23 OF THE PROSPECTUS REGULATION.

THE NODES NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA. FOR THESE PURPOSES, A RETAIL INVESTOR MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (“MIFID II”); OR (II) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97, WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN THE PROSPECTUS REGULATION. CONSEQUENTLY NO KEY INFORMATION DOCUMENT IS REQUIRED BY REGULATION (EU) NO 1286/2014 (THE “PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NODES OR OTHERWISE MAKING IT AVAILABLE TO RETAIL INVESTORS IN THE EEA HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE NODES OR OTHERWISE MAKING IT AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA MAY BE UNLAWFUL UNDER THE PRIIPS REGULATION. IT IS A CONDITION OF YOU RECEIVING AND RETAINING THIS DOCUMENT THAT YOU WARRANT THAT YOU ARE A QUALIFIED INVESTOR.

FOR THE PURPOSES OF THIS NOTICE, THE EXPRESSION AN “OFFER TO THE PUBLIC” IN RELATION TO ANY SECURITIES IN ANY MEMBER STATE MEANS THE COMMUNICATION IN ANY FORM AND BY ANY MEANS OF SUFFICIENT INFORMATION ON THE TERMS OF THE OFFER AND THE SECURITY BEING OFFERED SO AS TO ENABLE AN INVESTOR TO DECIDE TO PURCHASE THE SECURITY, AS THE SAME MAY BE VARIED IN THAT MEMBER STATE BY ANY MEASURE IMPLEMENTING THE PROSPECTUS REGULATION IN THAT MEMBER STATE. THE EXPRESSION “PROSPECTUS REGULATION” MEANS REGULATION (EU) 2017/1129 (AS AMENDED), AND INCLUDES ANY RELEVANT IMPLEMENTING MEASURE IN ANY MEMBER STATE.

NOTICE TO RESIDENTS OF THE UNITED KINGDOM

TO THE EXTENT THE AGREEMENT IS A TRANSFERABLE SECURITY IN THE UNITED KINGDOM, THIS AGREEMENT IS BEING DISTRIBUTED ONLY TO, AND IS DIRECTED ONLY AT (AND ANY INVESTMENT ACTIVITY TO WHICH IT RELATES WILL BE ENGAGED ONLY WITH): (I) INVESTMENT PROFESSIONALS (WITHIN THE MEANING OF ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 AS AMENDED (THE “FPO”)); (II) PERSONS OR ENTITIES OF A KIND DESCRIBED IN ARTICLE 49 OF THE FPO; (III) CERTIFIED SOPHISTICATED INVESTORS (WITHIN THE MEANING OF ARTICLE 50(1) OF THE FPO); AND (IV) OTHER PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT PERSONS”).

THIS AGREEMENT HAS NOT BEEN APPROVED BY AN AUTHORISED PERSON. ANY INVESTMENT TO WHICH THIS AGREEMENT RELATES IS AVAILABLE ONLY TO (AND ANY INVESTMENT ACTIVITY TO WHICH IT RELATES WILL BE ENGAGED ONLY WITH) RELEVANT PERSONS. THIS AGREEMENT IS DIRECTED ONLY AT RELEVANT PERSONS AND PERSONS WHO ARE NOT RELEVANT PERSONS SHOULD NOT TAKE ANY ACTION BASED UPON THIS AGREEMENT AND SHOULD NOT RELY ON IT. IT IS A CONDITION OF YOU RECEIVING AND RETAINING THIS AGREEMENT THAT YOU WARRANT TO THE COMPANY, ITS MANAGERS, AND ITS OFFICERS THAT YOU ARE A RELEVANT PERSON.

NOTICE TO RESIDENTS OF THE BRITISH VIRGIN ISLANDS

TO THE EXTENT THE AGREEMENT IS A TRANSFERABLE SECURITY IN THE UNITED KINGDOM, THIS AGREEMENT IS BEING DISTRIBUTED ONLY TO, AND IS DIRECTED ONLY AT (AND ANY INVESTMENT ACTIVITY TO WHICH IT RELATES WILL BE ENGAGED ONLY WITH): (I) INVESTMENT PROFESSIONALS (WITHIN THE MEANING OF ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 AS AMENDED (THE “FPO”)); (II) PERSONS OR ENTITIES OF A KIND DESCRIBED IN ARTICLE 49 OF THE FPO; (III) CERTIFIED SOPHISTICATED INVESTORS (WITHIN THE MEANING OF ARTICLE 50(1) OF THE FPO); AND (IV) OTHER PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT PERSONS”).

NOTICE TO RESIDENTS OF THE CAYMAN ISLANDS

THIS AGREEMENT DOES NOT CONSTITUTE A PUBLIC OFFER OF SECURITIES, WHETHER BY WAY OF SALE OR SUBSCRIPTION, IN THE CAYMAN ISLANDS. NO SOLICITATION MAY BE MADE TO THE PUBLIC IN THE CAYMAN ISLANDS TO PURCHASE THE SECURITIES OFFERED HEREBY, AND THIS AGREEMENT MAY NOT BE ISSUED OR PASSED TO ANY SUCH PERSON.

NOTICE TO RESIDENTS OF CHINA

PERSONS DOMICILED IN OR PURCHASING FROM THE PEOPLE’S REPUBLIC OF CHINA (EXCLUDING THE SPECIAL ADMINISTRATIVE REGIONS OF HONG KONG AND MACAU, AND THE ISLAND OF TAIWAN) ARE EXCLUDED FROM PURCHASING, EITHER DIRECTLY OR INDIRECTLY, THE AGREEMENT.

NOTICE TO RESIDENTS OF HONG KONG

THE CONTENTS OF THIS AGREEMENT HAVE NOT BEEN REVIEWED OR APPROVED BY ANY REGULATORY AUTHORITY IN HONG KONG. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THIS OFFER. IF YOU ARE IN ANY DOUBT ABOUT ANY OF THE CONTENTS OF THIS AGREEMENT, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE. THIS AGREEMENT DOES NOT CONSTITUTE AN OFFER OR INVITATION TO THE PUBLIC IN HONG KONG TO ACQUIRE THE NODES BEING OFFERED HEREIN. ACCORDINGLY, UNLESS PERMITTED BY THE LAWS OF HONG KONG, NO PERSON MAY ISSUE OR HAVE IN ITS POSSESSION FOR THE PURPOSES OF ISSUE, THIS AGREEMENT RELATING TO THE NODES BEING OFFERED, WHETHER IN HONG KONG OR ELSEWHERE, WHICH IS DIRECTED AT, OR THE CONTENTS OF WHICH ARE LIKELY TO BE ACCESSED OR READ BY, THE PUBLIC IN HONG KONG OTHER THAN IN CIRCUMSTANCES WHICH DO NOT RESULT IN THIS AGREEMENT CONSTITUTING A “PROSPECTUS” AS DEFINED IN THE COMPANIES (WINDING UP AND MISCELLANEOUS PROVISIONS) ORDINANCE OF HONG KONG (CAP. 32 OF THE LAWS OF HONG KONG) (THE “C(WUMP)O”) OR WHICH DO NOT CONSTITUTE AN OFFER OR AN INVITATION TO THE PUBLIC FOR THE PURPOSES OF THE SECURITIES AND FUTURES ORDINANCE (CAP. 571 OF THE LAWS OF HONG KONG) OR THE C(WUMP)O. THE OFFER OF THE NODES IS PERSONAL TO THE PERSON TO WHOM THIS AGREEMENT HAS BEEN DELIVERED, AND THE NODES WILL ONLY BE ACCEPTED BY SUCH PERSON. NO PERSON TO WHOM A COPY OF THIS AGREEMENT IS ISSUED MAY ISSUE, CIRCULATE OR DISTRIBUTE THIS AGREEMENT IN HONG KONG OR MAKE OR GIVE A COPY OF THIS AGREEMENT TO ANY OTHER PERSON.

NOTICE TO RESIDENTS IN AUSTRALIA

NEITHER THIS AGREEMENT, NOR ANY OTHER DISCLOSURE DOCUMENT IN RELATION TO THE OFFER OR SALE OF THE AGREEMENT OR RIGHTS UNDER THE AGREEMENT, HAS BEEN, WILL BE, OR NEEDS TO BE, LODGED WITH THE AUSTRALIAN SECURITIES & INVESTMENTS COMMISSION. THIS AGREEMENT IS NOT A PRODUCT DISCLOSURE STATEMENT UNDER DIVISION 2 OF PART 7.9 OF THE CORPORATIONS ACT 2001 (CTH) (“AUSTRALIAN CORPORATIONS ACT”) NOR IS IT A PROSPECTUS UNDER CHAPTER 6D OF THE AUSTRALIAN CORPORATIONS ACT, AND THE AGREEMENT HAS NOT BEEN, AND WILL NOT BE, REGISTERED AS A MANAGED INVESTMENT SCHEME UNDER THE AUSTRALIAN CORPORATIONS ACT.

THIS AGREEMENT IS NOT REQUIRED TO, AND DOES NOT, CONTAIN ALL THE INFORMATION WHICH WOULD BE REQUIRED IN A DISCLOSURE AGREEMENT OR PRODUCT DISCLOSURE STATEMENT, OR ALL THE INFORMATION THAT A PROSPECTIVE INVESTOR MAY DESIRE OR SHOULD OBTAIN IN ORDER TO MAKE AN INFORMED INVESTMENT DECISION. BY ACCEPTING RECEIPT OF THIS AGREEMENT, YOU REPRESENT AND WARRANT THAT YOU ARE A “SOPHISTICATED INVESTOR” AS DEFINED UNDER SECTION 708(8) OF THE CORPORATIONS ACT OR A “PROFESSIONAL INVESTOR” UNDER SECTION 708(11) OF THE CORPORATIONS ACT AND A “WHOLESALE CLIENT” UNDER SECTION 761G OF THE CORPORATIONS ACT. THE ISSUER OF THIS AGREEMENT IS NOT REGISTERED AS A MANAGED INVESTMENT SCHEME UNDER THE CORPORATIONS ACT. ANY PERSON TO WHOM THIS AGREEMENT IS ISSUED MUST NOT, WITHIN 12 MONTHS AFTER SUCH ISSUE, OFFER, TRANSFER OR ASSIGN THIS AGREEMENT TO PERSONS IN AUSTRALIA EXCEPT IN CIRCUMSTANCES WHERE DISCLOSURE TO SUCH PERSONS IS NOT REQUIRED UNDER THE CORPORATIONS ACT.

NO PERSON REFERRED TO IN THIS AGREEMENT HOLDS AN AUSTRALIAN FINANCIAL SERVICES LICENCE.

NEITHER THIS AGREEMENT, THE OFFERS CONTAINED HEREIN NOR ANY OTHER DISCLOSURE AGREEMENT IN RELATION TO THE AGREEMENT CAN BE PARTIALLY OR WHOLLY DISTRIBUTED, PUBLISHED, REPRODUCED, TRANSMITTED OR OTHERWISE MADE AVAILABLE OR DISCLOSED BY RECIPIENTS TO ANY PERSON IN AUSTRALIA OTHER THAN PROFESSIONAL INVESTORS.

NOTICE TO RESIDENTS OF GERMANY

IN THE FEDERAL REPUBLIC OF GERMANY THIS AGREEMENT IS DISTRIBUTED ONLY TO, AND IS DIRECTED ONLY AT, QUALIFIED INVESTORS WITHIN THE MEANING OF THE PROSPECTUS REGULATION, THAT PROFESSIONALLY OR COMMERCIALLY PURCHASE OR SELL SECURITIES OR INVESTMENT PRODUCTS (VERMÖGENSANLAGEN) WITHIN THE MEANING OF THE GERMAN INVESTMENT PRODUCT ACT (VERMÖGENSANLAGENGESETZ) FOR THEIR OWN ACCOUNT OR FOR THE ACCOUNT OF OTHERS. NO SECURITIES PROSPECTUS (WERTPAPIERPROSPEKT) OR INVESTMENT PRODUCT PROSPECTUS (VERMÖGENSANLAGENVERKAUFSPROSPEKT) HAS BEEN OR WILL BE FILED WITH THE GERMAN FEDERAL FINANCIAL SUPERVISORY AUTHORITY (BAFIN) OR OTHERWISE PUBLISHED IN THE FEDERAL REPUBLIC OF GERMANY. NO PUBLIC OFFER OR DISTRIBUTION OF COPIES OF ANY AGREEMENT RELATING TO THE NETWORK OR THE NODES INCLUDING THIS AGREEMENT, WILL BE MADE IN THE FEDERAL REPUBLIC OF GERMANY EXCEPT WHERE AN EXPRESS EXEMPTION FROM COMPLIANCE WITH THE PUBLIC OFFER RESTRICTIONS UNDER THE GERMAN SECURITIES PROSPECTUS ACT AND THE INVESTMENT PRODUCT ACT APPLIES.

NOTICE TO RESIDENTS OF FRANCE

THIS AGREEMENT HAS NOT BEEN PREPARED, AND IS NOT DISTRIBUTED, IN THE CONTEXT OF A PUBLIC OFFERING OF FINANCIAL SECURITIES IN FRANCE WITHIN THE MEANING OF ARTICLE L. 411-1 OF THE FRENCH CODE MONÉTAIRE ET FINANCIER. CONSEQUENTLY, NO FINANCIAL SECURITIES HAVE BEEN OFFERED OR SOLD OR WILL BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, TO THE PUBLIC IN FRANCE, AND ANY OFFERING MATERIAL MAY NOT BE, AND WILL NOT BE, DISTRIBUTED OR CAUSED TO BE DISTRIBUTED TO THE PUBLIC IN FRANCE OR USED IN CONNECTION WITH ANY OFFER TO THE PUBLIC IN FRANCE.

OFFERS, SALES AND DISTRIBUTIONS OF SECURITIES WILL BE MADE ONLY TO QUALIFIED INVESTORS (INVESTISSEURS QUALIFIÉS) ACTING FOR THEIR OWN ACCOUNT, ALL AS DEFINED IN, AND IN ACCORDANCE WITH, ARTICLES L. 411-2, D. 411-1, D. 744-1 D. 754-1, AND D. 764-1 OF THE FRENCH CODE MONÉTAIRE ET FINANCIER AND APPLICABLE REGULATIONS THEREUNDER.

PROSPECTIVE INVESTORS ARE INFORMED THAT (I) THIS AGREEMENT HAS NOT BEEN AND WILL NOT BE SUBMITTED TO THE CLEARANCE OF THE FRENCH FINANCIAL MARKET AUTHORITY (“AMF”), (II) IN COMPLIANCE WITH ARTICLES L. 411-1, D. 411-1, D. 744-1, D. 754-1, AND D. 764-1 OF THE FRENCH CODE MONÉTAIRE ET FINANCIER, ANY QUALIFIED INVESTOR SHOULD BE ACTING FOR ITS OWN ACCOUNT, AND (III) THE DIRECT OR INDIRECT DISTRIBUTION OR SALE TO THE PUBLIC OF SECURITIES MAY ONLY BE MADE IN COMPLIANCE WITH ARTICLES L. 411-1, L. 411-2, L. 412-1, AND L. 621-8 THROUGH L. 621-8-3 OF THE FRENCH CODE MONÉTAIRE ET FINANCIER.

NOTICE TO RESIDENTS OF SWITZERLAND

THIS AGREEMENT (AND ANY OTHER OFFERING OR MARKETING MATERIAL WITH RESPECT TO THE INVESTMENT ACTIVITY TO WHICH THIS AGREEMENT RELATES) MAY BE DISTRIBUTED OR MADE AVAILABLE IN, INTO OR FROM SWITZERLAND ONLY TO QUALIFIED INVESTORS WITHIN THE MEANING OF THE SWISS COLLECTIVE INVESTMENT SCHEMES ACT (“CISA”), ITS IMPLEMENTING ORDINANCE AND REGULATORY GUIDANCE (EACH SUCH PERSON A “QUALIFIED INVESTOR”). THIS AGREEMENT (NOR ANY OTHER OFFERING OR MARKETING MATERIAL WITH RESPECT TO THE INVESTMENT ACTIVITY TO WHICH THIS AGREEMENT RELATES) HAS NOT BEEN AND WILL NOT BE FILED WITH, OR APPROVED BY, ANY SWISS REGULATORY AUTHORITY. THIS AGREEMENT DOES NOT CONSTITUTE AN OFFER TO SUBSCRIBE FOR, BUY OR OTHERWISE ACQUIRE ANY NODES AND IT DOES NOT CONSTITUTE A PROSPECTUS PURSUANT TO THE CISA, THE SWISS CODE OF OBLIGATIONS OR THE LISTING RULES OF ANY TRADING VENUE IN SWITZERLAND. ANY INVESTMENT TO WHICH THIS AGREEMENT RELATES IS AVAILABLE ONLY TO (AND ANY INVESTMENT ACTIVITY TO WHICH IT RELATES WILL BE ENGAGED ONLY WITH) QUALIFIED INVESTORS.

NOTICE TO RESIDENTS OF SINGAPORE

THE OFFER OR SALE OF THE AGREEMENT DOES NOT RELATE TO A COLLECTIVE INVESTMENT SCHEME WHICH IS AUTHORISED UNDER SECTION 286 OF THE SECURITIES AND FUTURES ACT (THE “SFA”) OR RECOGNISED UNDER SECTION 287 OF THE SFA, CHAPTER 289 OF SINGAPORE. THIS AGREEMENT IS NOT AND HAS NOT BEEN REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE AND, ACCORDINGLY, STATUTORY LIABILITY UNDER THE SFA IN RELATION TO THE CONTENT OF PROSPECTUSES DOES NOT APPLY, AND YOU SHOULD EXERCISE CAUTION IN RELATION TO THE OFFER AND CONSIDER CAREFULLY WHETHER THE PURCHASE OF THE AGREEMENT IS SUITABLE FOR YOU. IF YOU ARE IN ANY DOUBT ABOUT ANY OF THE CONTENTS OF THIS AGREEMENT, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

THIS AGREEMENT AND ANY OTHER AGREEMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF THE AGREEMENT MAY NOT BE CIRCULATED OR DISTRIBUTED, NOR MAY THE AGREEMENT BE OFFERED OR SOLD, OR BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN TO AN ACCREDITED INVESTOR, AS SUCH TERM IS DEFINED IN THE SFA.

NOTICE TO RESIDENTS OF SOUTH KOREA

THIS AGREEMENT IS NOT, AND UNDER NO CIRCUMSTANCES IS TO BE CONSTRUED AS, AN OFFERING OF SECURITIES IN SOUTH KOREA UNDER THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT OF SOUTH KOREA (THE “FISCMA”). FOR THE PURPOSE OF THIS NOTICE, THE EXPRESSION “OFFERING” IN RELATION TO ANY SECURITIES UNDER FISCMA MEANS THE INVITATION OF SUBSCRIPTION FOR NEWLY ISSUED SECURITIES TO MORE THAN 50 RETAIL INVESTORS. THE NODES HAVE NOT BEEN REGISTERED UNDER THE FISCMA, AND THE NODES MAY NOT BE OFFERED, SOLD, TRANSFERRED, PLEDGED OR HYPOTHECATED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN SOUTH KOREA OR TO ANY RESIDENT OF SOUTH KOREA.

NOTICE TO RESIDENTS OF TAIWAN

THIS AGREEMENT MAY BE MADE AVAILABLE OUTSIDE TAIWAN FOR PURCHASE OUTSIDE TAIWAN BY TAIWAN RESIDENT INVESTORS, BUT MAY NOT BE OFFERED OR SOLD IN TAIWAN.

A PURCHASE OF THE NODES HEREUNDER INVOLVES A HIGH DEGREE OF RISK. PURCHASER ACKNOWLEDGES, AGREES AND UNDERSTANDS THAT THE NODES PURCHASED HEREUNDER ARE SUBJECT TO THE TERMS AND CONDITIONS SET FORTH IN THIS AGREEMENT AND THE DOCUMENTS REFERENCED HEREIN. BY PARTICIPATING IN THIS OFFERING, PURCHASER AGREES TO BE BOUND BY THIS AGREEMENT IN ALL RESPECTS. PURCHASER ACKNOWLEDGES, AGREES AND UNDERSTANDS THAT THE NODES ARE NOT SECURITIES BUT THAT THIS TRANSACTION IS INTENDED TO COMPLY WITH AND IS IN ACCORDANCE WITH ALL APPLICABLE SECURITIES LAWS.

SEIWHALE LIMITED

NODE PURCHASE AGREEMENT (“Agreement”)

NODE PURCHASE AGREEMENT (“Agreement”) THIS CERTIFIES THAT in exchange for the payment by the undersigned purchaser (the “Purchaser”) of the Total Purchase Price as set forth on the Company’s Website on the date the Purchaser agrees to this Agreement (the “Effective Date”), Seiwhale Limited, a company incorporated in the British Virgin Islands as a BVI Business Company (the “Company”), hereby sells to the Purchaser a number of Nodes (as defined below) equal to the number of such Nodes that Purchaser has selected on the Website, for a total purchase price specified on the Website (the “Total Purchase Price”), and subject to the terms set forth below.

OFFER AND SALE

• Purchase of Nodes. Purchaser understands and acknowledges that Purchaser is purchasing one or more Nodes in the quantity as set forth on the Website in consideration for the Total Purchase Price to be delivered to the Company.

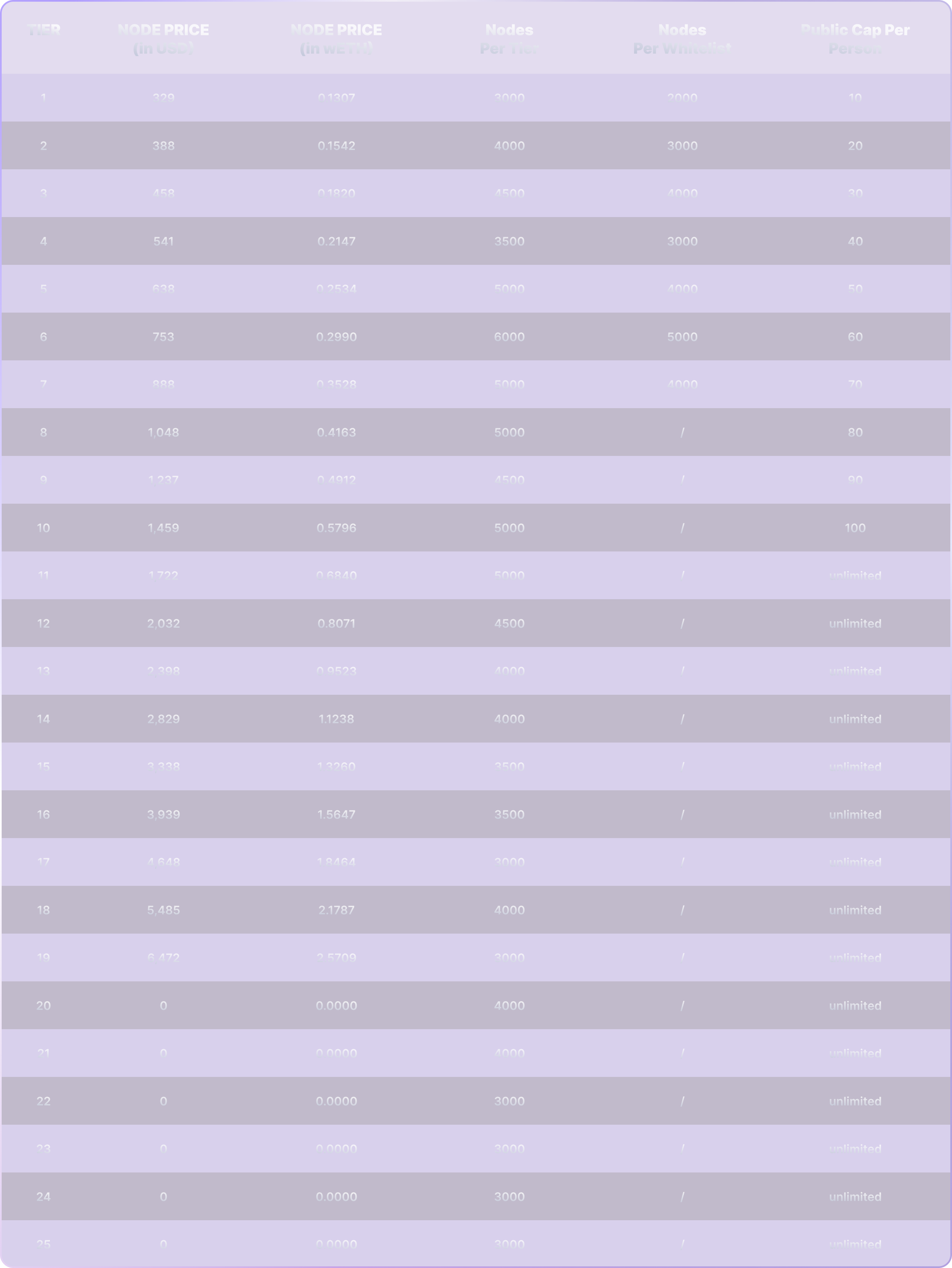

• Nodes Pricing Tiered Structure. The Nodes are available for sale in different pricing tiers as set forth in Exhibit A (the “Tiers”). There shall be no difference between the functionality of Nodes sold between Tiers. As more Nodes are sold and enter circulation, the price for Nodes (the “Node Price”) may increase in accordance with the table on the Website and/or Exhibit A. Nodes will start selling at Tier 1 and increase in Tier when the entire quantity of Nodes for the relevant Tier (the “Nodes Per Tier”) has been sold to purchasers. The Purchaser acknowledges that the Company may impose a limit on the number of Nodes that the Purchaser may purchase for each Tier. The Company may amend the table on the Website and/or Exhibit A in its sole discretion.

• Purchaser Qualification. Purchaser acknowledges and agrees that it satisfies certain requirements (which are outlined in this Agreement) in order to purchase the Nodes, including Purchaser’s residency and citizenship requirements, as well as compliance with this Agreement. Purchaser acknowledges and agrees that, in the event the Company determines that Purchaser does not meet the Company’s requirements for purchasers under this Agreement (as determined by the Company in its reasonable discretion), the Company may immediately and without notice rescind or terminate this Agreement and the Purchaser’s usage of the Nodes, notwithstanding Purchaser’s compliance with this Agreement and delivery of the Total Purchase Price to the Company.

• Payment. Purchaser covenants and agrees to pay the Total Purchase Price to the Company on the Effective Date. Purchaser acknowledges and agrees that the Company may, in its sole discretion, rescind or terminate this Agreement and the Purchaser’s usage of the Nodes in the event that Purchaser does not execute this Agreement or deliver the Total Purchase Price [five business days following the Effective Date].

• Form of Payment. The Company agrees to accept payment for the Total Purchase Price in the payment forms displayed on the Website. The U.S. dollar exchange rate for any other forms of payment shall be determined solely by the Company or its assignee or agent in accordance with reasonable and accepted market practices and additional transaction fees may apply. Purchaser agrees to send the Total Purchase Price to the Company’s wallet address set forth on the Website or otherwise provided to Purchaser in writing at the time of purchase.

• Refund. The Purchaser acknowledges and agrees that the Total Purchase Price shall not be refundable, in whole or in part, under any circumstances except as set forth herein. The Purchaser further acknowledges and agrees that the Nodes are non-refundable and cannot be exchanged for cash (or its equivalent value in any other virtual currency) or any payment obligation from the Company or any of its affiliates except as set forth herein.

• Delivery. The Company, its agents or representatives shall deliver to Purchaser’s Wallet (as defined below), in full satisfaction of this Agreement, the number of Nodes purchased as set forth on the Website.

• Method of Delivery. The Company will deliver the Nodes to the Purchaser in the form of with the form of delivery determined in the Company’s sole discretion.

• Method of Delivery. The Company will deliver the Nodes to the Purchaser in the form of with the form of delivery determined in the Company’s sole discretion.

• Conditions to Node Delivery. In connection with, as a condition to, and prior to delivery of the Nodes by the Company to Purchaser pursuant to Section 2.1, and in each case unless waived in writing by the Company:

• The Purchaser will execute and deliver to the Company any and all other transaction documents related to this Agreement and the delivery of the Nodes as are reasonably required to comply with then applicable laws or regulations, including documentation and information necessary to verify Purchaser’s residency, citizenship, and eligibility to enter into this Agreement;

• The Purchaser will provide to the Company a compliant network wallet addresses compatible with receiving the Nodes (“Wallet”) to which the Purchaser’s Nodes will be delivered; and

• The Purchaser will complete and deliver all AML and KYC Forms (as defined below) reasonably requested by the Company as the Company deems necessary to comply with then applicable laws and regulations.

• Lockup. The Nodes acquired herein shall be subject to the following restrictions (collectively, the “Lockup Provisions”):

• Prior to the twelve-month anniversary of the Effective Date, Purchaser agrees that it will not Transfer any of the Nodes acquired pursuant to this Agreement or any interest therein, any options to purchase any of the Nodes, or any instruments convertible into, exchangeable for, or that represent the right to receive any of the Nodes, whether now or hereinafter acquired by the Purchaser.

• To ensure compliance with these Lockup Provisions, the Company may impose, or cause the imposition of technological lockups or restrictions on the Nodes.

• Use of Nodes.

• Subject to the terms and conditions of this Agreement, the Purchaser may use the Nodes to contribute to the maintenance and integrity of the Bluwhale Protocol’s decentralized infrastructure. As a Node operator, the Purchaser will be able to help ensure that the correct state of the Bluwhale Protocol is reflected on the blockchain by reading assertion data, confirming the accuracy of information being submitted by the Nodes on the Bluwhale Protocol and utilizing a Wallet to perform assertion checks.

• In order to operate a Node, the Purchaser agrees to connect a third-party blockchain Wallet that is compatible with the Bluwhale Protocol. The Purchaser is solely responsible for maintaining the security of its Wallet, including any associated credentials, private key, and seed phrase. The Company does not offer Wallet software or custody of any cryptocurrency assets on behalf of the Purchaser. Furthermore, in no event shall the Company transfer, exchange, safekeep, or administrate any cryptocurrency assets on behalf of the Purchaser. The Purchaser’s use of a third-party Wallet is subject to separate terms and conditions established by the Wallet provider.

• The Node Software may automatically download or require the Purchaser to download and install updates onto its machine from time to time. By accessing or using the Node Software, the Purchaser agrees that the Company may download and install automatic Node Software updates onto the Purchaser’s machine. The Purchaser may opt out of automatic updates by adjusting its Node Software settings.

Network Rewards. The Purchaser may receive units of BLUAI tokens from the Bluwhale Protocol as a reward for operating the Nodes and contributing to the security of the Bluwhale Protocol (the “Network Rewards”). All such Network Rewards are programmatically distributed to Node operators by the Bluwhale Protocol.

Regarding the claim of Network Rewards, the following rules apply:

• If the Purchaser claims the Network Rewards immediately after distribution, a 50% penalty of the claimed Network Rewards will be imposed.

• If the Purchaser claims the Network Rewards within 1 month after distribution, a 40% penalty of the claimed Network Rewards will be imposed.

• If the Purchaser claims the Network Rewards within 2 months after distribution, a 30% penalty of the claimed Network Rewards will be imposed.

• If the Purchaser claims the Network Rewards within 3 months after distribution, a 25% penalty of the claimed Network Rewards will be imposed.

• The Purchaser can claim the Network Rewards in full without any penalty 120 days after the distribution date.

In the event the Purchaser transfers any of the Network Rewards before being eligible to claim them in full (as per the above schedule), twenty-five percent of the relevant transferred Network Rewards shall be forfeited by the Purchaser. Additionally, some or all of the Purchaser’s Network Rewards may be programmatically destroyed as a penalty imposed by the Bluwhale Protocol in certain instances and at the Company’s sole discretion.

• Intellectual Property. All aspects of any intellectual property rights in connection with the Nodes, Node Software and Bluwhale Protocol, including, without limitation, any works of authorship, trademarks, features, or functionality, and other intellectual property, are owned by the Company, its affiliates, licensors, or other providers of such material and are protected by applicable copyright, trademark, patent, trade secret, and other intellectual property or proprietary rights laws. The Bluwhale Protocol and all related names, logos, product and service names, designs, and slogans are trademarks of the Company or its affiliates or licensors. Purchaser is not permitted to use such marks without the prior written permission of the Company. Except for the License expressly granted to the Purchaser hereunder, no other license is granted and no other use is permitted.

• Termination. This Agreement will expire and terminate upon one of the following events occurring:

• the issuance of all Nodes to the Purchaser;

• the return/refund of the Total Purchase Price to the Purchaser (minus any expenses, fees or amounts incurred by the Company to facilitate the distribution to the Purchaser), which may occur in cases where the Company decides to no longer offer any Nodes to the Purchaser in accordance with this Agreement;

• in the event that the Company determines, in its sole discretion, that the Purchaser has pooled their funds, formed a syndicate and/or utilised crowd sourced funding in connection with purchasing the Nodes;

• the Purchaser fails to satisfy the KYC, anti-money laundering and counter terrorist financing checks prescribed by the Company in accordance with Section 2.3.3;

• the mutual agreement between the Company and the Purchaser; or

• the dissolution or winding up of the Company.

Notwithstanding the above, either party may terminate this Agreement by written notice to the other party if the terminating party has reasonable grounds to believe that the other party has breached or failed to perform any of its representations, warranties, covenants or agreements set forth in this Agreement (each, a “Termination Trigger Event”) and if such breach or non-performance is capable of remedy, such party fails to remedy such breach or non-performance within ten (10) days of receipt of a written notice served by the other party requiring it to do so. The terminating party must provide at least ten (10) days’ prior written notice of such intention to the other party.

• Effects of Termination. Upon termination of this Agreement:

• all of the Purchaser’s rights under this Agreement immediately terminate;

• the Purchaser shall not be entitled to receive any Nodes beyond such Nodes that the Company has delivered to the Purchaser prior to such termination;

• the Purchaser shall not be entitled to any refund of any amount paid whatsoever, save in the case where:

• this Agreement is terminated by the Company (X) without the occurrence of any Termination Trigger Event by the Purchaser; and (Y) the Purchaser has not, directly or indirectly, caused the Nodes to be undelivered to the Purchaser, as determined by the Company in good faith;

• such a refund is required by applicable law or regulation; or

• this Agreement is terminated pursuant to Section 3.1.2 to Section 3.1.6 above.

• Effects of Termination. Upon termination of this Agreement:

In the event that a refund is available to the Purchaser in the circumstances stated above, the Purchaser will receive a refund of the remaining Total Purchase Price corresponding to the Nodes that have not been delivered to the Purchaser prior to such termination (less any expenses, fees or costs that have been reasonably incurred by the Company in connection with the Nodes sale and/or to facilitate the processing or distribution of such refund amount to the Purchaser).

• Survival. Sections 5, 6 and 7 will survive the termination of this Agreement.

OFFER AND SALE

• Purchase of Nodes. Purchaser understands and acknowledges that Purchaser is purchasing one or more Nodes in the quantity as set forth on the Website in consideration for the Total Purchase Price to be delivered to the Company.

• Nodes Pricing Tiered Structure. The Nodes are available for sale in different pricing tiers as set forth in Exhibit A (the “Tiers”). There shall be no difference between the functionality of Nodes sold between Tiers. As more Nodes are sold and enter circulation, the price for Nodes (the “Node Price”) may increase in accordance with the table on the Website and/or Exhibit A. Nodes will start selling at Tier 1 and increase in Tier when the entire quantity of Nodes for the relevant Tier (the “Nodes Per Tier”) has been sold to purchasers. The Purchaser acknowledges that the Company may impose a limit on the number of Nodes that the Purchaser may purchase for each Tier. The Company may amend the table on the Website and/or Exhibit A in its sole discretion.

• Purchaser Qualification. Purchaser acknowledges and agrees that it satisfies certain requirements (which are outlined in this Agreement) in order to purchase the Nodes, including Purchaser’s residency and citizenship requirements, as well as compliance with this Agreement. Purchaser acknowledges and agrees that, in the event the Company determines that Purchaser does not meet the Company’s requirements for purchasers under this Agreement (as determined by the Company in its reasonable discretion), the Company may immediately and without notice rescind or terminate this Agreement and the Purchaser’s usage of the Nodes, notwithstanding Purchaser’s compliance with this Agreement and delivery of the Total Purchase Price to the Company.

• Payment. Purchaser covenants and agrees to pay the Total Purchase Price to the Company on the Effective Date. Purchaser acknowledges and agrees that the Company may, in its sole discretion, rescind or terminate this Agreement and the Purchaser’s usage of the Nodes in the event that Purchaser does not execute this Agreement or deliver the Total Purchase Price [five business days following the Effective Date].

• Form of Payment. The Company agrees to accept payment for the Total Purchase Price in the payment forms displayed on the Website. The U.S. dollar exchange rate for any other forms of payment shall be determined solely by the Company or its assignee or agent in accordance with reasonable and accepted market practices and additional transaction fees may apply. Purchaser agrees to send the Total Purchase Price to the Company’s wallet address set forth on the Website or otherwise provided to Purchaser in writing at the time of purchase.

• Refund. The Purchaser acknowledges and agrees that the Total Purchase Price shall not be refundable, in whole or in part, under any circumstances except as set forth herein. The Purchaser further acknowledges and agrees that the Nodes are non-refundable and cannot be exchanged for cash (or its equivalent value in any other virtual currency) or any payment obligation from the Company or any of its affiliates except as set forth herein.

• Delivery. The Company, its agents or representatives shall deliver to Purchaser’s Wallet (as defined below), in full satisfaction of this Agreement, the number of Nodes purchased as set forth on the Website.

• Method of Delivery. The Company will deliver the Nodes to the Purchaser in the form of with the form of delivery determined in the Company’s sole discretion.

• Method of Delivery. The Company will deliver the Nodes to the Purchaser in the form of with the form of delivery determined in the Company’s sole discretion.

• Conditions to Node Delivery. In connection with, as a condition to, and prior to delivery of the Nodes by the Company to Purchaser pursuant to Section 2.1, and in each case unless waived in writing by the Company:

• The Purchaser will execute and deliver to the Company any and all other transaction documents related to this Agreement and the delivery of the Nodes as are reasonably required to comply with then applicable laws or regulations, including documentation and information necessary to verify Purchaser’s residency, citizenship, and eligibility to enter into this Agreement;

• The Purchaser will provide to the Company a compliant network wallet addresses compatible with receiving the Nodes (“Wallet”) to which the Purchaser’s Nodes will be delivered; and

• The Purchaser will complete and deliver all AML and KYC Forms (as defined below) reasonably requested by the Company as the Company deems necessary to comply with then applicable laws and regulations.

• Lockup. The Nodes acquired herein shall be subject to the following restrictions (collectively, the “Lockup Provisions”):

• Prior to the twelve-month anniversary of the Effective Date, Purchaser agrees that it will not Transfer any of the Nodes acquired pursuant to this Agreement or any interest therein, any options to purchase any of the Nodes, or any instruments convertible into, exchangeable for, or that represent the right to receive any of the Nodes, whether now or hereinafter acquired by the Purchaser.

• To ensure compliance with these Lockup Provisions, the Company may impose, or cause the imposition of technological lockups or restrictions on the Nodes.

• Use of Nodes.

• Subject to the terms and conditions of this Agreement, the Purchaser may use the Nodes to contribute to the maintenance and integrity of the Bluwhale Protocol’s decentralized infrastructure. As a Node operator, the Purchaser will be able to help ensure that the correct state of the Bluwhale Protocol is reflected on the blockchain by reading assertion data, confirming the accuracy of information being submitted by the Nodes on the Bluwhale Protocol and utilizing a Wallet to perform assertion checks.

• In order to operate a Node, the Purchaser agrees to connect a third-party blockchain Wallet that is compatible with the Bluwhale Protocol. The Purchaser is solely responsible for maintaining the security of its Wallet, including any associated credentials, private key, and seed phrase. The Company does not offer Wallet software or custody of any cryptocurrency assets on behalf of the Purchaser. Furthermore, in no event shall the Company transfer, exchange, safekeep, or administrate any cryptocurrency assets on behalf of the Purchaser. The Purchaser’s use of a third-party Wallet is subject to separate terms and conditions established by the Wallet provider.

• The Node Software may automatically download or require the Purchaser to download and install updates onto its machine from time to time. By accessing or using the Node Software, the Purchaser agrees that the Company may download and install automatic Node Software updates onto the Purchaser’s machine. The Purchaser may opt out of automatic updates by adjusting its Node Software settings.

Network Rewards. The Purchaser may receive units of BLUAI tokens from the Bluwhale Protocol as a reward for operating the Nodes and contributing to the security of the Bluwhale Protocol (the “Network Rewards”). All such Network Rewards are programmatically distributed to Node operators by the Bluwhale Protocol.

Regarding the claim of Network Rewards, the following rules apply:

• If the Purchaser claims the Network Rewards immediately after distribution, a 50% penalty of the claimed Network Rewards will be imposed.

• If the Purchaser claims the Network Rewards within 1 month after distribution, a 40% penalty of the claimed Network Rewards will be imposed.

• If the Purchaser claims the Network Rewards within 2 months after distribution, a 30% penalty of the claimed Network Rewards will be imposed.

• If the Purchaser claims the Network Rewards within 3 months after distribution, a 25% penalty of the claimed Network Rewards will be imposed.

• The Purchaser can claim the Network Rewards in full without any penalty 120 days after the distribution date.

In the event the Purchaser transfers any of the Network Rewards before being eligible to claim them in full (as per the above schedule), twenty-five percent of the relevant transferred Network Rewards shall be forfeited by the Purchaser. Additionally, some or all of the Purchaser’s Network Rewards may be programmatically destroyed as a penalty imposed by the Bluwhale Protocol in certain instances and at the Company’s sole discretion.

• Intellectual Property. All aspects of any intellectual property rights in connection with the Nodes, Node Software and Bluwhale Protocol, including, without limitation, any works of authorship, trademarks, features, or functionality, and other intellectual property, are owned by the Company, its affiliates, licensors, or other providers of such material and are protected by applicable copyright, trademark, patent, trade secret, and other intellectual property or proprietary rights laws. The Bluwhale Protocol and all related names, logos, product and service names, designs, and slogans are trademarks of the Company or its affiliates or licensors. Purchaser is not permitted to use such marks without the prior written permission of the Company. Except for the License expressly granted to the Purchaser hereunder, no other license is granted and no other use is permitted.

• Termination. This Agreement will expire and terminate upon one of the following events occurring:

• the issuance of all Nodes to the Purchaser;

• the return/refund of the Total Purchase Price to the Purchaser (minus any expenses, fees or amounts incurred by the Company to facilitate the distribution to the Purchaser), which may occur in cases where the Company decides to no longer offer any Nodes to the Purchaser in accordance with this Agreement;

• in the event that the Company determines, in its sole discretion, that the Purchaser has pooled their funds, formed a syndicate and/or utilised crowd sourced funding in connection with purchasing the Nodes;

• the Purchaser fails to satisfy the KYC, anti-money laundering and counter terrorist financing checks prescribed by the Company in accordance with Section 2.3.3;

• the mutual agreement between the Company and the Purchaser; or

• the dissolution or winding up of the Company.

Notwithstanding the above, either party may terminate this Agreement by written notice to the other party if the terminating party has reasonable grounds to believe that the other party has breached or failed to perform any of its representations, warranties, covenants or agreements set forth in this Agreement (each, a “Termination Trigger Event”) and if such breach or non-performance is capable of remedy, such party fails to remedy such breach or non-performance within ten (10) days of receipt of a written notice served by the other party requiring it to do so. The terminating party must provide at least ten (10) days’ prior written notice of such intention to the other party.

• Effects of Termination. Upon termination of this Agreement:

• all of the Purchaser’s rights under this Agreement immediately terminate;

• the Purchaser shall not be entitled to receive any Nodes beyond such Nodes that the Company has delivered to the Purchaser prior to such termination;

• the Purchaser shall not be entitled to any refund of any amount paid whatsoever, save in the case where:

• this Agreement is terminated by the Company (X) without the occurrence of any Termination Trigger Event by the Purchaser; and (Y) the Purchaser has not, directly or indirectly, caused the Nodes to be undelivered to the Purchaser, as determined by the Company in good faith;

• such a refund is required by applicable law or regulation; or

• this Agreement is terminated pursuant to Section 3.1.2 to Section 3.1.6 above.

• Effects of Termination. Upon termination of this Agreement:

In the event that a refund is available to the Purchaser in the circumstances stated above, the Purchaser will receive a refund of the remaining Total Purchase Price corresponding to the Nodes that have not been delivered to the Purchaser prior to such termination (less any expenses, fees or costs that have been reasonably incurred by the Company in connection with the Nodes sale and/or to facilitate the processing or distribution of such refund amount to the Purchaser).

• Survival. Sections 5, 6 and 7 will survive the termination of this Agreement.

• DEFINITIONS

• “AML and KYC Forms” means any and all forms, documents, processes and procedures, including, for the avoidance of doubt, any electronic verification system or process, which the Company determines, in its sole discretion, are reasonably necessary for the Company to comply with applicable Money Laundering Laws and “know your customer” laws.

• “Bluwhale Protocol” means the Bluwhale protocol as described in the Company’s whitepaper.

• “Governmental Authority” means any nation or government, any state or other political subdivision thereof, any entity exercising legislative, judicial or administrative functions of or pertaining to government, including, without limitation, any government authority, agency, department, board, commission or instrumentality, and any court, tribunal or arbitrator(s) of competent jurisdiction, and any self-regulatory organization.

• “License” means a non-exclusive, revocable, non-transferable, non-sublicensable, royalty-free, limited license to install, use and run the Node Software on one or more machines that the Purchaser owns or controls.

• “Money Laundering Laws” means the applicable laws, rules and regulations of all jurisdictions in which the Purchaser is located, resident, organized or operates concerning or related to anti-money laundering, including but not limited to those contained in the Bank Secrecy Act of 1970 and the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “Patriot Act”), each as amended and including the rules and regulations thereunder, and any related or similar rules, regulations or guidelines, issued, administered or enforced by any Governmental Authority.

• “NFT” means a non-fungible token that will allow the Purchaser to access and operate the Node.

• “Node” means a software node that connects to other nodes over a blockchain network to validate all transactions and blocks according to the Bluwhale Protocol rules and records a complete copy of the blockchain.

• “Node Software” means the application or program that runs on a computer or server, enabling it to act as a Node.

• “Person” means any individual or legal entity, including a government or political subdivision or an agency or instrumentality thereof.

• “Transfer” means, with respect to any instrument, the direct or indirect assignment, sale, transfer, tender, pledge, hypothecation, or the grant, creation or suffrage of a lien or encumbrance in or upon, or the gift, placement in trust, or other disposition of such instrument or any right, title or interest therein, or the record or beneficial ownership thereof, the offer to make such a sale, transfer or other disposition, and each agreement, arrangement or understanding, whether or not in writing, to effect any of the foregoing.

• “Website” means the Company’s website.

• PURCHASER REPRESENTATIONS AND COVENANTS

• Authorization. The Purchaser has full power and authority to enter into this Agreement. This Agreement, when executed and delivered by the Purchaser, will constitute valid and legally binding obligations of the Purchaser, enforceable in accordance with their terms, except as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, and any other laws of general application affecting enforcement of creditors’ rights generally, and as limited by laws relating to the availability of specific performance, injunctive relief, or other equitable remedies.

• Purchase Entirely for Own Account. This Agreement is made with the Purchaser in reliance upon the Purchaser’s representation to the Company, which by the Purchaser’s execution of this Agreement, the Purchaser hereby confirms that the Nodes to be acquired by the Purchaser will be acquired for investment for the Purchaser’s own account, not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that the Purchaser has no present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, the Purchaser further represents that the Purchaser does not presently have any contract, undertaking, agreement or arrangement with any Person to sell, Transfer or grant participations to such Person or to any third Person, with respect to any of the Nodes. The Purchaser has not been formed for the specific purpose of acquiring the Nodes.

• Disclosure of Information. The Purchaser has sufficient knowledge of and experience in business and financial matters to be able to evaluate the risks and merits of its purchase of Nodes and is able to bear the risks thereof. The Purchaser has not relied on any representations or warranties made by the Company outside of this instrument, including, but not limited to, conversations of any kind, whether through oral or electronic communication, or any white paper.

• Compliance with Securities Laws. The Purchaser understands that the Nodes have not been, and will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”) or any applicable state securities laws, by reason of a specific exemption from the registration provisions of the Securities Act and other applicable state securities laws which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Purchaser’s representations as expressed herein. The Purchaser understands that the Nodes may be deemed “restricted securities” under applicable United States federal and state securities laws and that, pursuant to these laws, the Purchaser must hold the Nodes indefinitely unless they are registered with the Securities and Exchange Commission and qualified by state authorities, or an exemption from such registration and qualification requirements is available. The Purchaser acknowledges that the Company has no obligation to register or qualify the Nodes for resale, and exemptions from registration and qualification may not be available or may not permit the Purchaser to transfer all or any of the Nodes in the amounts or at the times proposed by the Purchaser. The Purchaser further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Nodes, and on requirements relating to the Company which are outside of the Purchaser’s control, and which the Company is under no obligation and may not be able to satisfy.

• No Public Market. The Purchaser understands that no public market now exists for the Nodes, and that the Company has not made any assurances that a public market will ever exist for the Nodes and the Company is not under any obligation to register or qualify the Nodes under the laws of any Governmental Authority.

• Legends. The Purchaser understands that the Nodes may be deemed to bear any one or more of the following legends: (a) any legend required by the securities laws of any state to the extent such laws are applicable to the Nodes represented by the certificate so legended, and (b): the following legend (and even without such legend the following restrictions apply):

THE NODES PURCHASED HEREUNDER HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND HAVE BEEN ACQUIRED TO HOLD FOR THE LONG TERM AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO TRANSFER MAY BE EFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO UNLESS SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933, AS AMENDED.

Purchaser hereby agrees that, to enforce the restrictions set forth in this Agreement, the Company may impose technological and other restrictions on the Wallet and the Nodes deliverable hereunder.

• Other Applicable Law. Purchaser represents that it has satisfied itself as to the full observance of the laws of its jurisdiction in connection with the purchase of the Nodes, including (i) the legal requirements within the Purchaser’s jurisdiction for the purchase of the Nodes, (ii) any foreign exchange restrictions applicable to such purchase, (iii) any governmental or other consents that may need to be obtained, and (iv) the income tax and other tax consequences, if any, that may be relevant to the purchase, holding, redemption, sale, or transfer of the Nodes. The Purchaser’s purchase and payment for and continued beneficial ownership of the Nodes will not violate any applicable laws of the Purchaser’s jurisdiction.

• Regulation S Representations and Restrictions. Purchaser hereby agrees and represents to the Company as follows:

• Purchaser is not in the United States, is not a U.S. Person as defined in Rule 902(k) of Regulation S under the Securities Act, and is not acquiring the Nodes for the account or benefit of any U.S. Person. The Purchaser understands that a “U.S. person”, as defined by Regulation S, includes any natural person resident in the United States; any partnership or corporation organized or incorporated under the laws of the United States; any estate of which any executor or administrator is a “U.S. person”; any trust of which any trustee is a “U.S. person”; any agency or branch of a foreign entity located in the United States; any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit or account of a “U.S. person”; any discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated, or (if any individual) resident in the United States; and any partnership or corporation organized or incorporated under the laws of a jurisdiction other than the United States which was formed by a “U.S. person” principally for the purpose of investing in securities not registered under the Act, unless it is organized or incorporated, and owned, by accredited investors (as defined in Rule 501(a) of Regulation D promulgated under the Act) who are not natural persons, estates or trusts.

• Purchaser will not, during the restricted period that is applicable to the Nodes set forth in the legend set forth below (the “Restricted Period”) and to any certificate representing the Nodes, offer or sell any of the foregoing (or create or maintain any derivative position equivalent thereto) in the United States, to or for the account or benefit of a U.S. Person or other than in accordance with Regulation S, or engage in hedging transactions with regard to the Nodes prior to the expiration of the Restricted Period unless in compliance with the Securities Act.

• Purchaser will, after the expiration of the applicable Restricted Period, offer, sell, pledge or otherwise Transfer the Nodes (or create or maintain any derivative position equivalent thereto) only pursuant to registration under the Securities Act or any available exemption therefrom and, in any case, in accordance with applicable state securities laws.

• Purchaser acknowledges and agrees that the Nodes will be deemed to bear the legend set forth below (in addition to any other legends required by applicable federal, state, or foreign securities laws or provided in any other agreement with the Company):

THE NODES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”) WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION, AND NEITHER THE COMPANY NOR THE COMPANY INTENDS TO REGISTER THEM. PRIOR TO THE ONE-YEAR ANNIVERSARY OF THE DATE OF SALE, THE NODES MAY NOT BE OFFERED OR SOLD (INCLUDING OPENING A SHORT POSITION IN SUCH NODES) IN THE UNITED STATES OR TO U.S. PERSONS AS DEFINED BY RULE 902(k) ADOPTED UNDER THE ACT, OTHER THAN TO DISTRIBUTORS, UNLESS THE NODES ARE REGISTERED UNDER THE ACT, OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE ACT IS AVAILABLE. PRIOR TO THE ONE-YEAR ANNIVERSARY OF THE DATE OF SALE, YOU MAY RESELL SUCH NODES ONLY PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE ACT OR OTHERWISE IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S OF THE ACT, OR IN TRANSACTIONS EFFECTED OUTSIDE OF THE UNITED STATES PROVIDED THEY DO NOT SOLICIT (AND NO ONE ACTING ON THEIR BEHALF SOLICITS) PURCHASERS IN THE UNITED STATES OR OTHERWISE ENGAGE(S) IN SELLING EFFORTS IN THE UNITED STATES AND PROVIDED THAT HEDGING TRANSACTIONS INVOLVING THESE NODES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE ACT. A HOLDER OF THE NODES WHO IS A DISTRIBUTOR, DEALER, SUB-UNDERWRITER OR OTHER SECURITIES PROFESSIONAL, IN ADDITION, CANNOT, PRIOR TO THE ONE YEAR ANNIVERSARY OF THE DATE OF SALE, RESELL THE NODES TO A U.S. PERSON AS DEFINED BY RULE 902(k) OF REGULATION S UNLESS THE NODES ARE REGISTERED UNDER THE ACT OR AN EXEMPTION FROM REGISTRATION UNDER THE ACT IS AVAILABLE.

• Neither the Purchaser nor any person acting on its behalf has engaged, or will engage, in any directed selling efforts to U.S. Persons with respect to the Nodes, except that Purchaser may sell or otherwise dispose of any of the Nodes pursuant to an effective registration statement or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The purchase of the Nodes herein has not been pre-arranged with a buyer located in the United States or with a U.S. Person, and are not part of a plan or scheme to evade the requirements of the Securities Act. The Purchaser understands that Directed selling efforts” means any activity undertaken for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States for any of the securities being offered in reliance on this Regulation S (§ 230.901 through § 230.905, and Preliminary Notes). Such activity includes placing an advertisement in a publication “with a general circulation in the United States” that refers to the offering of securities being made in reliance upon this Regulation S.

• OFAC. Neither the Purchaser, nor, if applicable, any of its affiliates or direct or indirect beneficial owners; (i) appears on the Specially Designated Nationals and Blocked Persons List of the Office of Foreign Assets Control of the United States Department of the Treasury (“OFAC”), nor are they otherwise a party with which the Company is prohibited to deal under the laws of the United States; (ii) is a person identified as a terrorist organization on any other relevant lists maintained by any Governmental Authority; (iii) resides in the United States of America, Canada, the United Kingdom, Cuba, Iran, North Korea, Syria, Belarus, Russia, or the Crimea, Luhansk, Donetsk, Zaporizhzhia, or Kherson regions of Ukraine, or any other jurisdiction subject to comprehensive sanctions pursuant to OFAC Regulations (defined below); or (iv) unless otherwise disclosed in writing to the Company prior to the date of this Agreement, is a senior foreign political figure, or any immediate family member or close associate of a senior foreign political figure. The Purchaser further represents and warrants that, if applicable, the Purchaser: (a) has conducted thorough due diligence with respect to all of its beneficial owners; (b) has established the identities of all direct and indirect beneficial owners and the source of each beneficial owners’ funds; and (c) will retain evidence of those identities, any source of funds and any due diligence.

• Sources and Uses of Funds. The Purchaser further represents, warrants and agrees as follows:

• No payment or other transfer of value to the Company and shall cause the Company to be in violation of applicable U.S. federal or state or non-U.S. laws or regulations, including, without limitation, anti-money laundering, economic sanctions, anti-bribery or anti-boycott laws or regulations, the Patriot Act, or the various statutes, regulations and executive orders administered by OFAC (“OFAC Regulations”).

• No payment or other transfer of value to the Company is or will be derived from, pledged for the benefit of, or related in any way to, (i) the government of any country designated by the

U.S. Secretary of State or other Governmental Authority as a country supporting international terrorism,

(ii) property that is blocked under any OFAC Regulations or that would be blocked under OFAC Regulations if it were in the custody of a U.S. national, (iii) persons to whom U.S. nationals cannot lawfully export services, or with whom U.S. nationals cannot lawfully engage in transactions under OFAC Regulations, (iv) the government of any country that has been designated as a non- cooperative country or designated by the U.S. Secretary of the Treasury or other Governmental Authority as a money laundering jurisdiction or (v) directly or indirectly, any illegal activities. The Purchaser acknowledges that Money Laundering Laws may require the Company to collect documentation verifying the identity and the source of funds used to acquire the Nodes before, and from time to time after, the date of this Agreement.

• Additional Information. The Purchaser will provide to the Company information that the Company from time to time reasonably determines to be necessary or appropriate (i) to comply with OFAC Regulations, Money Laundering Laws, anti-terrorism laws, rules and regulations and or any similar laws and regulations of any applicable jurisdiction and (ii) to respond to requests for information concerning the identity and or source of funds of the Purchaser from any Governmental Authority, self-regulatory organization or financial institution in connection with its anti-money laundering compliance procedures, or to update that information. The Purchaser understands and acknowledges that the Company may be required to report any action or failure to comply with information requests and to disclose the identity to Governmental Authorities, self-regulatory organizations and financial institutions, in certain circumstances without notifying the Purchaser that the information has been so provided. The Purchaser further understand and agrees that any failure on its part to comply with this Section 5.11 would allow the Company to terminate this Agreement and require the forfeiture of any Nodes previously delivered to the Purchaser.

• Voluntary Compliance. The Purchaser understands and agrees that, even if the Company is not obligated to comply with any U.S. anti-money laundering requirements, the Company may nevertheless choose to voluntarily comply with such requirements as the Company deems appropriate in its sole discretion. The Purchaser agrees to cooperate with the Company as may be required in the reasonable opinion of the Company in connection with such compliance.

• Taxes. PURCHASER ACKNOWLEDGES AND AGREES THAT IT MAY SUFFER ADVERSE TAX CONSEQUENCES AS A RESULT OF PURCHASING, HOLDING, EXCHANGING, SELLING, TRANSFERRING OR OTHERWISE USING THE NODES IN ANY WAY. PURCHASER HEREBY REPRESENTS THAT (A) IT HAS CONSULTED WITH A TAX ADVISER THAT IT DEEMS ADVISABLE IN CONNECTION WITH ANY USE OF THE NODES, OR THAT IT HAS HAD THE OPPORTUNITY TO OBTAIN TAX ADVICE BUT HAVE CHOSEN NOT TO DO SO, (B) NEITHER THE COMPANY NOR ANY OF ITS AFFILIATES HAS PROVIDED PURCHASER WITH ANY TAX ADVICE, AND (C) PURCHASER AGREES TO BE FULLY RESPONSIBLE FOR ANY TAXES RESULTING FROM ANY PURCHASE, HOLDING, EXCHANGE, SALE, STAKING, TRANSFER OR OTHER USE OF THE NODES.

• Purchaser Covenants.

• Purchaser shall not engage in any activities that negatively affect the technical performance of the Nodes, Node Software and/or the Bluwhale Protocol, bypass or circumvent security features of the Nodes, Node Software and/or the Bluwhale Protocol, or otherwise disrupt or interfere with the functioning of the Nodes, Node Software and/or the Bluwhale Protocol. Purchaser shall not violate or attempt to violate the security of the Nodes, Node Software and/or the Bluwhale Protocol or otherwise misuse the foregoing, including by, (i) accessing data not intended for Purchaser or logging onto a server or an account which Purchaser is not authorized to access; (ii) disabling, removing, defeating or avoiding any security device or system; (iii) attempting to probe, scan or test the vulnerability of the Nodes, Node Software and/or the Bluwhale Protocol or to breach security or authentication measures without proper authorization; (iv) attempting to interfere with service to any sentry node operator, host or network, including, but not limited to, via means of submitting any malware or computer programming routines that may damage, disrupt or interfere with, intercept or expropriate any system or data, overloading, “flooding,” “spamming,” “mailbombing” or “crashing” the Nodes, Node Software and/or the Bluwhale Protocol; (v) forging any transmission control protocol/internet protocol packet header or any part of the header information in any email or posting; (vi) using the Nodes, Node Software and/or the Bluwhale Protocol in a manner that exceeds reasonable request volume or constitutes excessive or abusive usage; or (vii) providing false, misleading or inaccurate information to the Bluwhale Protocol.

• Purchaser shall not, directly or indirectly: (i) use the Nodes or Node Software or any portion thereof to create any service, software, product, platform, documentation or data that is similar to, in whole or in part, any aspect of the services or products offered by the Company, including without limitation, the Node Software or Bluwhale Protocol; (ii) disassemble, decompile, reverse engineer or use any other means to attempt to discover any source code of the Node Software, or the underlying ideas, file formats, algorithms or trade secrets therein; (iii) encumber, sublicense, transfer, rent, lease, time-share or use the Node Software in any service bureau arrangement or otherwise for the benefit of any third party; (iv) copy, distribute, manufacture, adapt, create derivative works of, translate, localize, port or otherwise modify any software code or documentation for the Node Software; (v) use or allow the transmission, transfer, export, re-export or other transfer of any product, technology or information it obtains or learns pursuant to this Agreement (or any direct product thereof) in violation of any export control or other laws and regulations of any relevant jurisdiction; (vi) knowingly introduce into the Node Software and/or Bluwhale Protocol any malicious code, computer virus, spyware, scareware, Trojan horses, worms, malware or any other similar harmful, malicious or hidden programs or data; (vii) remove or modify any proprietary markings or restrictive legends placed on the Node Software; (viii) use the Node Software to infringe upon, violate or misappropriate any third party' s intellectual property rights, violating any law or regulation or being defamatory, trade libelous, threatening or harassing; or (ix) authorize or permit any third party to engage in any of the foregoing proscribed acts.

• Purchaser shall not use the Nodes, Node Software and/or Bluwhale Protocol to engage in illegal activity of any kind, including, without limitation, any activity that would violate, or assist in violation of, any law, statute, ordinance, regulation or sanctions programs administered under any applicable law.

• DISCLAIMERS

• Wallet. Purchaser assumes full responsibility and liability for any losses resulting from any intentional or unintentional misuse of the Wallet including, without limitation, any loss resulting from designating a non-compliant wallet for the receipt of any of the Nodes, or depositing one type of digital asset to a wallet intended for another type of digital asset. The Company assumes no responsibility or liability in connection with any such misuse.

• Indemnity. NEITHER THE COMPANY NOR ANY OF ITS AFFILIATES SHALL BE LIABLE TO THE PURCHASER, AND THE PURCHASER WILL INDEMNIFY, DEFEND AND HOLD HARMLESS THE COMPANY, ITS AFFILIATES AND THEIR AGENTS AND ADVISORS, AND THE SUCCESSORS AND ASSIGNS OF THE FOREGOING, FROM AND AGAINST, ALL OR ANY PART OF ANY THIRD PARTY CAUSES OF ACTION, CLAIMS, LIABILITIES, LOSSES, COSTS, DAMAGES AND EXPENSES (INCLUDING ATTORNEYS’ FEES AND EXPENSES) (COLLECTIVELY “CLAIMS”) FOR DAMAGES TO OR LOSS OF PROPERTY ARISING OUT OF OR RESULTING FROM THE TRANSACTIONS CONTEMPLATED HEREIN.

• Limitation of Liability. NEITHER THE COMPANY NOR ANY OF ITS AFFILIATES SHALL BE LIABLE OR RESPONSIBLE TO THE PURCHASER, NOR BE DEEMED TO HAVE DEFAULTED UNDER OR BREACHED THIS AGREEMENT, FOR ANY FAILURE OR DELAY IN FULFILLING OR PERFORMING ANY TERM OF THIS AGREEMENT, INCLUDING WITHOUT LIMITATION, SELLING THE NODES, SENDING THE NODES TO THE WALLET, OR DISTRIBUTING THE NODES, WHEN AND TO THE EXTENT SUCH FAILURE OR DELAY IS CAUSED BY OR RESULTS FROM ACTS BEYOND THE AFFECTED PARTY'S COMMERCIALLY REASONABLE CONTROL, INCLUDING, WITHOUT LIMITATION: (A) ACTS OF GOD; (B) FLOOD, FIRE, EARTHQUAKE, PANDEMICS OR EXPLOSION; (C) WAR, INVASION, HOSTILITIES (WHETHER WAR IS DECLARED OR NOT), TERRORIST THREATS OR ACTS, OR OTHER CIVIL UNREST; (D) APPLICABLE LAW OR REGULATIONS; OR (E) ACTION BY ANY GOVERNMENTAL AUTHORITY. THE COMPANY MAKES NO WARRANTY WHATSOEVER WITH RESPECT TO THE NODES, INCLUDING ANY (A) WARRANTY OF MERCHANTABILITY; (B) WARRANTY OF FITNESS FOR A PARTICULAR PURPOSE; (C) WARRANTY OF TITLE; OR (D) WARRANTY AGAINST INFRINGEMENT OF INTELLECTUAL PROPERTY RIGHTS OF A THIRD PARTY; WHETHER ARISING BY LAW, COURSE OF DEALING, COURSE OF PERFORMANCE, USAGE OF TRADE, OR OTHERWISE. EXCEPT AS EXPRESSLY SET FORTH HEREIN, PURCHASER ACKNOWLEDGES THAT IT HAS NOT RELIED UPON ANY REPRESENTATION OR WARRANTY MADE BY THE COMPANY, OR ANY OTHER PERSON ON THE COMPANY'S BEHALF.

THE PURCHASER UNDERSTANDS THAT PURCHASER HAS NO RIGHT AGAINST THE COMPANY, ITS AFFILIATES OR ANY OTHER INDIVIDUAL OR LEGAL ENTITY EXCEPT IN THE EVENT OF THE COMPANY’S MATERIAL BREACH OF THIS INSTRUMENT OR INTENTIONAL FRAUD. THE COMPANY’S (OR ANY OTHER INDIVIDUAL’S OR LEGAL ENTITY’S) AGGREGATE LIABILITY ARISING OUT OF OR RELATED TO THIS AGREEMENT, WHETHER ARISING OUT OF OR RELATED TO BREACH OF CONTRACT, TORT OR OTHERWISE, SHALL NOT EXCEED USD1,000.00. NEITHER THE COMPANY NOR ITS REPRESENTATIVES SHALL BE LIABLE FOR CONSEQUENTIAL, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY, PUNITIVE OR ENHANCED DAMAGES, LOST PROFITS OR REVENUES OR DIMINUTION IN VALUE, ARISING OUT OF OR RELATING TO ANY BREACH OF THIS INSTRUMENT.

• Waiver of Warranties; Assumption of Risks. THE RISK OF LOSS IN BUYING, HOLDING AND TRADING DIGITAL ASSETS AND RIGHTS THEREIN, INCLUDING THE NODES, CAN BE IMMEDIATE AND SUBSTANTIAL. THERE IS NO GUARANTEE AGAINST LOSSES FROM PARTICIPATING IN THE OFFERING. PURCHASER SHOULD THEREFORE CAREFULLY CONSIDER WHETHER TRADING OR HOLDING VIRTUAL CURRENCY IS SUITABLE FOR THE PURCHASER IN

LIGHT OF ITS FINANCIAL CONDITION. Purchaser understands that the Nodes involve risks, all of which the Purchaser fully and completely assumes, including, but not limited to, the risks that (i) the technology and economic models associated with Bluwhale Protocol will not function as intended; (ii) Bluwhale Protocol will fail to attract sufficient interest from users; (iii) Bluwhale Protocol and/or the network will not be completed and the Nodes will not become or remain functional; and (iv) the Company, its affiliates and/or third parties involved in the development of Bluwhale Protocol may be subject to investigation and punitive actions from Governmental Authorities. Purchaser understands and expressly accepts that the Nodes will be created and delivered to the Purchaser at the sole risk of the Purchaser on an “AS IS” and “UNDER DEVELOPMENT” basis. NEITHER THE COMPANY NOR ANY OF ITS AFFILIATES MAKES ANY WARRANTY WHATSOEVER WITH RESPECT TO THE NODES, INCLUDING ANY (i) WARRANTY OF MERCHANTABILITY; (ii) WARRANTY OF FITNESS FOR A PARTICULAR PURPOSE; (iii) WARRANTY OF TITLE; OR (iv) WARRANTY AGAINST INFRINGEMENT OF INTELLECTUAL PROPERTY RIGHTS OF A THIRD PARTY; WHETHER ARISING BY LAW, COURSE OF DEALING, COURSE OF PERFORMANCE, USAGE OF TRADE, OR OTHERWISE. EXCEPT AS EXPRESSLY SET FORTH HEREIN, PURCHASER ACKNOWLEDGES THAT IT HAS NOT RELIED UPON ANY REPRESENTATION OR WARRANTY MADE BY THE COMPANY, OR ANY OTHER PERSON ON ITS BEHALF. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, PURCHASER ASSUMES ALL RISKS AND LIABILITIES FOR THE RESULTS OBTAINED BY THE USE OF ANY NODES AND REGARDLESS OF ANY ORAL OR WRITTEN STATEMENTS MADE BY THE COMPANY OR ITS AFFILIATES, BY WAY OF TECHNICAL ADVICE OR OTHERWISE, RELATED TO THE USE OF THE NODES.

• Class Action Waiver. Any claim or dispute arising under this Agreement will take place on an individual basis without resort to any form of class or representative action (the “Class Action Waiver”). THIS CLASS ACTION WAIVER PRECLUDES ANY PARTY FROM PARTICIPATING IN OR BEING REPRESENTED IN ANY CLASS OR REPRESENTATIVE ACTION REGARDING A CLAIM. Regardless of anything else in this Agreement to the contrary, the validity and effect of the Class Action Waiver may be determined only by a court or referee and not by an arbitrator, and Purchaser acknowledges that this Class Action Waiver is material and essential to the arbitration of any disputes between the parties and is non- severable from this Agreement.

• Confidentiality. Purchaser agrees that such Purchaser and its affiliates will keep confidential and will not disclose, divulge, or use for any purpose any information obtained from the Company that is marked as confidential or that a reasonable person would understand to be confidential, unless such information (a) is known or becomes known to the public in general, (b) is or has been independently developed or conceived by such Purchaser without use of the Company’s confidential information, or (c) is or has been made known or disclosed to such Purchaser by a third party without a breach of any obligation of confidentiality such third party may have to the Company; provided, however, that Purchaser may disclose confidential information (i) to its attorneys, accountants, consultants, and other professionals to the extent reasonably necessary to obtain their services in connection with monitoring its rights or obligations under this Agreement; or (ii) as may otherwise be required by law regulation, rule, court order or subpoena, provided that Purchaser promptly notifies the Company of such disclosure and takes reasonable steps to minimize the extent of any such required disclosure.

• MISCELLANEOUS

• Entire Agreement. This Agreement sets forth the entire agreement and understanding of the parties relating to the subject matter herein and supersedes all prior or contemporaneous disclosures, discussions, understandings and agreements, whether oral of written, between them. Any provision of this Agreement may be amended, waived or modified only upon the written consent of the Company and the Purchaser.

• Notices. Any notice required or permitted by this Agreement will be deemed sufficient when sent by email to the relevant address provided at the time of purchase of the Node.

• No Rights as Stockholder. The Purchaser is not entitled, as a holder of this Agreement, to vote or receive dividends or be deemed an equityholder of the Company for any purpose, nor will anything contained herein be construed to confer on the Purchaser, as such, any of the rights of an equityholder or any right to vote for the election of directors or upon any matter submitted to the board of directors at any meeting thereof, or to give or withhold consent to any corporate action or to receive notice of meetings, or to receive subscription rights or otherwise.

• Transfers and Assigns. The rights contained in this Agreement may not be Transferred, by operation of law or otherwise, by the Purchaser without the prior written consent of the Company. The Company may assign its rights under this Agreement without the consent of the Purchaser.

• Severability. In the event any one or more of the provisions of this Agreement is for any reason held to be invalid, illegal or unenforceable, in whole or in part or in any respect, or in the event that any one or more of the provisions of this Agreement operate or would prospectively operate to invalidate the Agreement, then and in any such event, such provision(s) only will be deemed null and void and will not affect any other provision of this Agreement and the remaining provisions will remain operative and in full force and effect and will not be affected, prejudiced, or disturbed thereby.

• Dispute Resolution. This Agreement shall be governed by and construed in accordance with the laws of the British Virgin Islands without giving regard to or any application of conflicts of law rules or principles. Any dispute, controversy, difference or claim arising out of or relating to this Agreement, including the existence, validity, interpretation, performance, breach or termination thereof or any dispute regarding non-contractual obligations arising out of or relating to it shall be referred to and finally resolved by arbitration administered by the British Virgin Islands International Arbitration Centre (the “BVIIAC”) under the BVIIAC Administered Arbitration Rules in force when the relevant Notice of Arbitration is submitted. The law of this arbitration clause shall be under the laws of the British Virgin Islands. The seat of arbitration shall be the British Virgin Islands. The number of arbitrators shall be one. The arbitration proceedings shall be conducted in English.

• Additional Assurances. The Purchaser shall, and shall cause its affiliates to, from time to time, execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably requested by Company or are necessary for the Company, upon the advice of counsel, to carry out the provisions of this Agreement and give effect to the transactions contemplated hereby, including, without limitation, to enable the Company to register the Nodes, to enable the Nodes to qualify for or maintain an exemption from registration (to the extent any such exemptions are available), to comply with Money Laundering Laws, or to otherwise complete the transactions contemplated hereby and to comply with applicable laws as then in effect.

• Force Majeure. Without limitation of anything else in this Agreement, neither the Company nor any of its affiliates shall be liable or responsible to the Purchaser, nor be deemed to have defaulted under or breached this Agreement, for any failure or delay in fulfilling or performing any term of this Agreement when and to the extent such failure or delay is caused by or results from acts beyond the affected party's reasonable control, including, without limitation: (a) acts of God; (b) flood, fire, pandemics, earthquake or explosion; (c) war, invasion, hostilities (whether war is declared or not), terrorist threats or acts, or other civil unrest or instability; (d) changes to applicable law; or (e) action by any Governmental Authority.

• Third Party Rights. Except as expressly provided in Section 6.2, a person who is not a party to this Agreement shall not have any rights under the Contracts (Rights of Third Parties) Act (as amended) to enforce any terms thereof. Notwithstanding any term of this Agreement, the consent of or notice to any person who is not a party to this Agreement shall not be required for any termination or rescission or any agreement to any variation, waiver, assignment, novation, release or settlement under this Agreement at any time.

Exhibit A